British manufacturers made more cars in 2015 than any year since 2005 when 1,595,697 vehicles were produced.

According to the Society of Motor Manufacturers and Traders, production increased 3.9% on 2014, with output at 1,587,677 overtaking pre-recession levels for the first time.

It was also a good year for commercial vehicles built in Britain. British commercial vehicle manufacturing rose by a third in 2015 when almost 95,000 CVs rolled off production lines.

Demand surged by a third in both domestic and overseas markets, with Europe taking the lion’s share of exports (88%), followed by Asia (6.3%) and the Luton-made Vauxhall Vivaro was top.

Meanwhile, manufacturers closed 2015 on a high note, with output for December up 7.7% compared with 2014, driven equally by British and overseas markets.

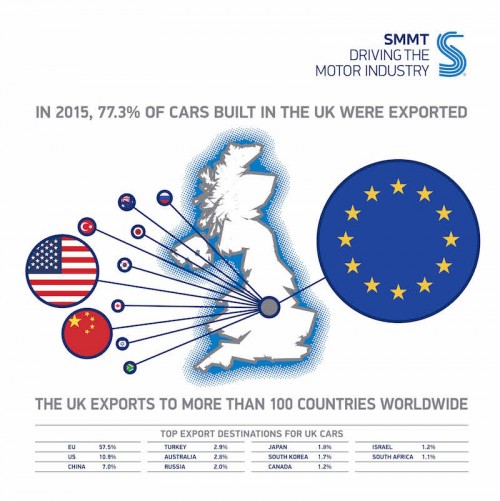

A record number of cars – representing 77.3% of total production – was for export, with 1,227,881 units leaving the UK, up 2.7% on 2014 levels.

JLR overtook Nissan for most models made in the UK.

Challenges were experienced in some global markets such as China, where demand fell by 37.5%, and Russia, where export volumes declined 69.4%.

However, the economic recovery in Europe, the UK’s biggest trading partner, boosted demand for UK-built cars by 11.3% in 2015. The region now accounts for 57.5% of all UK car exports.

Appetite for British-built cars grew significantly in other key and emerging regions, demonstrating the strength and diversity of UK manufacturing and product.

In the US, demand rose by more than a quarter (26.5%), making it the UK’s biggest trading destination outside the EU, ahead of China.

Meanwhile, notable growth was also seen in Australia, South Korea, Turkey and Japan with volumes up 53.7%, 55.2%, 41.1% and 35.4% respectively.

British consumer and business demand for British-made cars also contributed to last year’s success, with the home car market rising 8.1% on the previous year. One in seven new cars registered in the UK in 2015 was made in Britain.

Mike Hawes, SMMT Chief Executive, said, “Despite export challenges in some key markets such as Russia and China, foreign demand for British-built cars has been strong, reaching record export levels in the past year. “Achieving these hard fought for results is down to vital investment in the sector, world class engineering and a committed and skilled UK workforce – one of the most productive in the world.

“Continued growth in an intensely competitive global marketplace is far from guaranteed, however, and depends heavily on global economic conditions and political stability.

“Europe is our biggest trading partner and the UK’s membership of the European Union is vital for the automotive sector in order to secure future growth and jobs.”

Although car making rose in the UK last year, engine production dipped very slightly by 1.1% under 2014.

The drop was steepest in December when production declined 4.4% but it still meant 66% went abroad to vehicle assembly plants during 2015.

In 2015, EU passenger car sales grew by 9.3% compared to 2014, bringing the total number of cars sold to 13.7 million units.

“But after several rocky years since the 2008 financial crisis, the European car market is moving in the right direction again,” explained ACEA President Dieter Zetsche.

“This is great progress, but we are still well below the 2007 pre-crisis level of 15.5 million cars.” The picture is very similar for production numbers, with EU passenger car output up 6.2% in 2015 compared to 2014. In total, around 15.9 million cars were produced last year – still down from almost 17 million in 2007.

“For 2016 we anticipate a much more modest sales increase for both passenger cars and commercial vehicles,” stated Zetsche. “We expect car sales to go up by around 2%, reaching roughly 14 million units.”

Calling for support to tap into greater market opportunities for Europe’s auto manufacturers and suppliers, Zetsche stated: “We need political partners that continue to stand by the principles of free trade. The auto industry – like virtually every other European industry – can best thrive in an environment without trade barriers.”

Dr Zetsche also reiterated the industry’s commitment to contribute constructively to an updated laboratory test for measuring pollutant and CO2 emissions (WLTP), as well as an additional test to measure pollutant emissions under real driving conditions (RDE). Zetsche: “There is no doubt; we need new test cycles in Europe. However, important regulations on CO2, emissions and test cycles continue to be drafted separately – disregarding important interconnections. One fairly small step to better regulation would simply be to harmonise introduction dates to a reasonable extent.”