The UK’s used car market declined by -8.3% in the first quarter of 2020, said the Society of Motor Manufacturers and Traders.

The UK’s used car market declined by -8.3% in the first quarter of 2020, said the Society of Motor Manufacturers and Traders.

Growth in January and February, up 2.9% and 4.0% respectively, was wiped out by a -30.7% fall in March, making it the lowest March on record as coronavirus measures that came into effect and closed retailers.

Demand for pre-owned plug-in electric vehicles grew 13.6% in the first quarter, after a bumper first two months when buyers took advantage of more of these zero, and zero-emission capable, models appearing on the used market. The number of hybrids changing hands also rose, up 11.5%, taking the total number of used alternatively fuelled vehicle (AFV) sales to 36,493.

Meanwhile, petrol and diesel car transactions decreased -9.3% and -7.8% respectively, though combined they still accounted for 97.9% of all used sales in the quarter, equivalent to 1,814,598 cars.

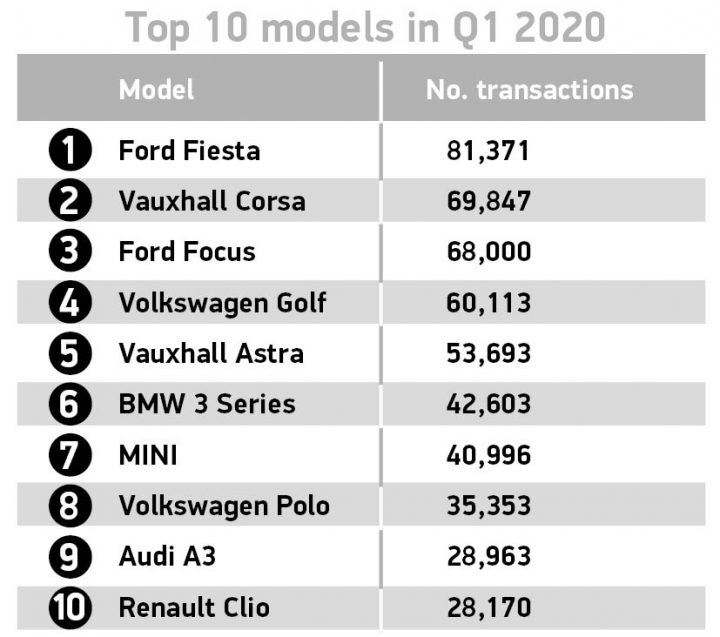

Reflecting trends in the new car market, superminis remained the most popular used buy, with 610,859 transactions, equating to 33.0% of the market but almost all segments saw a fall in demand, apart from dual purpose, which rose 2.7% with just over a quarter of a million finding new owners.

Black remained the most popular colour choice with 394,177 units sold, followed by silver/aluminium, blue, grey and white. The only car colour to see a rise in demand was bronze, which saw an increase of 1.6%.

Despite the challenging market conditions, the latest industry data indicates that average used car residuals are holding firm, with prices in March remaining broadly stable, down only -0.2% year-on-year at £13,601. Data also suggests that, despite lockdown measures being in effect, consumers are continuing to search and browse used cars online with many still looking to buy when the time is right.2

Mike Hawes, SMMT Chief Executive, said, “Encouraging growth for used car sales was wiped out in March as the coronavirus lockdown measures were introduced and, this subdued activity is likely to continue into the second quarter.

“While it is tricky to predict future demand, the impact of social distancing requirements on public transport means that, for many people, the car will play an even more important role in helping them travel safely to work. Re-opening new and used car outlets will support this, enabling more of the latest, cleanest vehicles to filter through to second owners and help support the UK’s green growth agenda.”

Motor cycle sales fell over in March as well.

The full effect of dealership closures was felt in April 2020 with a -83.5% drop in registrations against April 2019,” said Stephen Latham, Head of the National Motorcycle Dealers Association which represents motorcycle retailers across the UK.

Just 1,623 new motorcycles were registered in April, down from 9,820 in the previous April. Year-to-date, the market has declined by -31.1%, from 36,951 in 2019 to 25,451 in 2020 so far.

All sectors of machine were negatively affected, with ‘touring’ motorcycles plummeting -96.3%, while even the least affected ‘scooters’ registered a loss of -69.2%.

Honda once again was the best-selling brand with 312 new motorcycles, but preference for low powered and cheaper vehicles allowed Lexmoto to climb to second with 177 registrations.

Latham continued: “Most of the small number of registrations in April are likely to have been from online sales, with many being sold to key workers as a safe, independent option to travel to work.

“With the ongoing lockdown, many motorcycle businesses are looking to having a digital presence to sell new and used bikes online. This will help them weather the storm against them as we reach almost two months of closures, and the NMDA will continue to support their businesses throughout.”