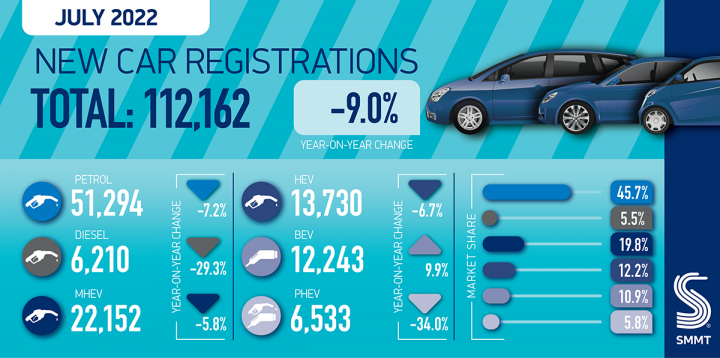

UK new car registrations fell 9.0% to reach 112,162 units in July, according to the Society of Motor Manufacturers and Traders.

The result marks the fifth month of consecutive decline, although the fall is the smallest recorded this year.

Ongoing global supply chain issues, predominantly the lack of semiconductors, continued to frustrate order fulfilment, exacerbated by Covid lockdowns in key manufacturing and logistics centres in China, plus disruption from the war in Ukraine, all of which restricted production output and thus supply into the UK new car market.

Declines were driven primarily by a -18.2% fall in registrations by large fleets, to 50,014 units, while consumer registrations remained steady at 59,847 units. As a result, private registrations in the year to date are now 3.7% up on 2021 as manufacturers prioritise private customers.

Battery electric vehicle (BEV) uptake grew 9.9% to 12,243 units to achieve a 10.9% market share for the month.

The first half of the year has proved more challenging than anticipated, due to the enduring severity and impact of the semiconductor shortage and global conflict. It has been particularly bad for Ford, traditionally the UK market leader but which has not figured in the top ten in July.

While the sector expects the second half to improve as supply issues start to recede, it is unlikely that the market will be able to recover the significant losses sustained so far.

Likewise, although the 2023 outlook has also been revised downwards since the April estimate, it is likely to be an improvement on 2022, with overall registrations anticipated to reach to 1.89 million (rather than 2.02mn), with plug-ins comprising 27.8% of the market.

July is a typically quiet month in the motor retail sector and this is reflected in the number of new vehicles being registered, said Sue Robinson, Chief Executive of the National Franchised Dealers Association.

“The demand for EVs continues to rise due to a combination of new and exciting models on offer, the increasing cost of petrol and diesel and growing expertise, thanks to schemes like the NFDA’s electric vehicle approved, amongst retailers.”

James Fairclough, ceo of AA Cars added, “In the current fragile market, used cars have a clear advantage over their brand new rivals – availability. We’ve seen this first-hand on the AA Cars website, with many would-be buyers using our platform to shop for a used vehicle that’s available to drive away today.

“While surging demand has pushed up second-hand prices in many parts of the country, there are some competitive used deals to be had, particularly for buyers who do their research and consider searching outside their local area.”