Classic cars have outperformed gold in terms of investment opportunity over the past decade.

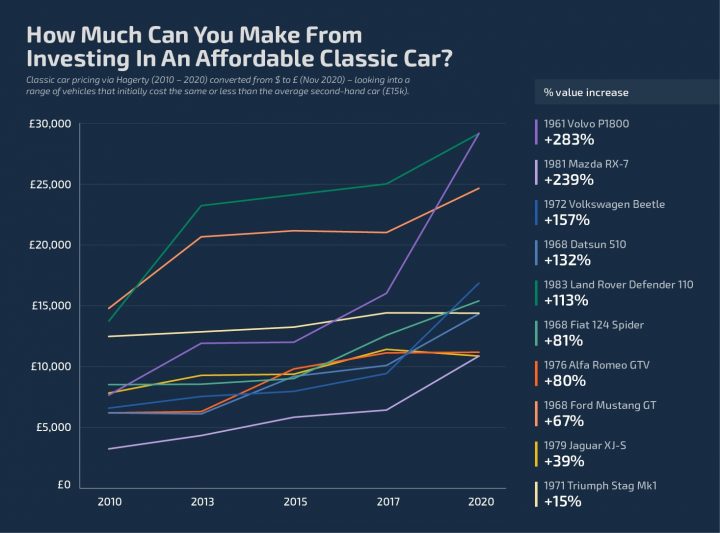

Using Hagerty’s average pricing for classic cars, Vanarama reviewed how much a classic car can appreciate in a mere decade. In 2020, the average second hand car lists for £15,000 according to the NFDA – so Vanarama have looked at 10 affordable classic cars under £15,000 and tracked their increase in value 5 times between 2010 and 2020.

The research reveals that the average value increase of a classic car that you could buy for under £15k is an impressive 97% in just 10 years.

Vanarama also looked at how the value of commodities like stock, property and art would increase in value if you paid in the same price of the average second-hand car (£15k).

To provide an honest comparison – they have averaged the value increase across all the cars in the study to find that they still all offer better return on investment than property, art, gold and savings accounts.

| Investment | % Change – 3 years | % Change – 5 years | % Change – 7 years | % Change – 10 years |

| Stocks | 35% | 65% | 101% | 107% |

| Classic Cars | 19% | 33% | 50% | 97% |

| UK Property | 14% | 23% | 33% | 50% |

| Art | 13% | 22% | 32% | 49% |

| Gold | 12% | 20% | 30% | 45% |

| Average Savings Account | 1% | 1% | 2% | 3% |